The Oracle of Omaha: Unraveling the Warren Buffett Phenomenon

From Paperboy to Billionaire: Buffett's Business Acumen and Charitable Vision

TL;DR

Self-Made Billionaire: How Warren Buffett turned a childhood fascination with numbers into a multi-billion-dollar empire.

Philanthropic Giant: Pledged to give away over 99% of his fortune to philanthropic causes, primarily through the Gates Foundation.

Investment Philosophy: Buffett's value investing principles have guided Berkshire Hathaway to unparalleled success.

Business Empire: From Coca-Cola to Apple, Buffett’s investments span across the most influential companies globally.

Personal Insight: Beyond investments, Buffett's life reflects a unique blend of simplicity, wisdom, and a keen interest in teaching financial literacy.

Biography

Warren Edward Buffett, born August 30, 1930, in Omaha, Nebraska, is not just a self-made billionaire but a symbol of enduring success in the global investment landscape. His early life showed signs of an entrepreneurial spirit; by age six, Buffett was already selling chewing gum and Coca-Cola door-to-door. His education at the University of Nebraska and Columbia Business School, where he was mentored by Benjamin Graham, the father of value investing, laid the foundational principles of his investment strategy.

Buffett's key career milestones include taking control of Berkshire Hathaway in 1965, transforming it from a struggling textile mill into a colossal conglomerate. His challenges were many, including navigating through financial crises and making high-stakes investment decisions that often contradicted popular market trends. Notable achievements include consistently outperforming the S&P 500 and becoming one of the wealthiest individuals on the planet, all while maintaining an unassuming lifestyle in Omaha.

Significant Accomplishments

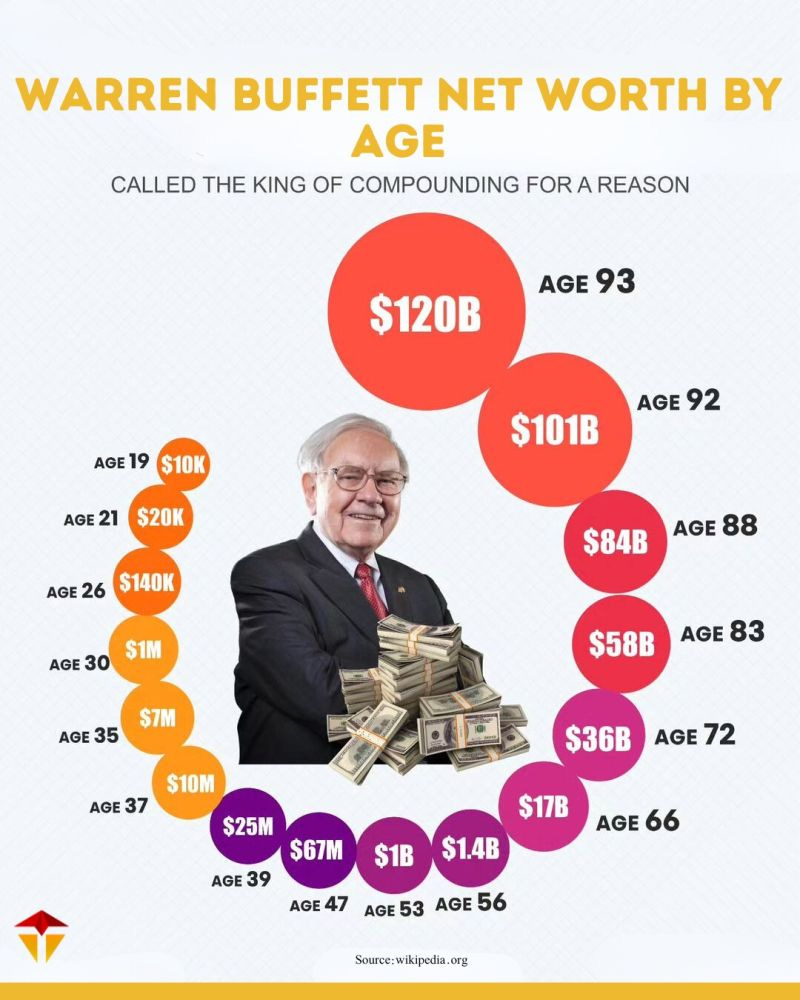

Buffett's most significant business achievements revolve around his extraordinary ability to assess value and make long-term investments that yield exceptional returns. He has championed the concept of value investing—buying stocks at a price less than their intrinsic value and holding them for the long term. Under his leadership, Berkshire Hathaway has seen astronomical growth, with its per-share book value growing from $19 to over $261,000 between 1965 and 2019.

Businesses

Berkshire Hathaway, under Buffett’s stewardship, owns a vast array of businesses and investments with a market cap exceeding $500 billion. Its portfolio includes significant stakes in Apple, Bank of America, Coca-Cola, and American Express, among others. Buffett's investments have not only yielded substantial returns but also influenced corporate governance and business practices across industries.

Charlie Munger

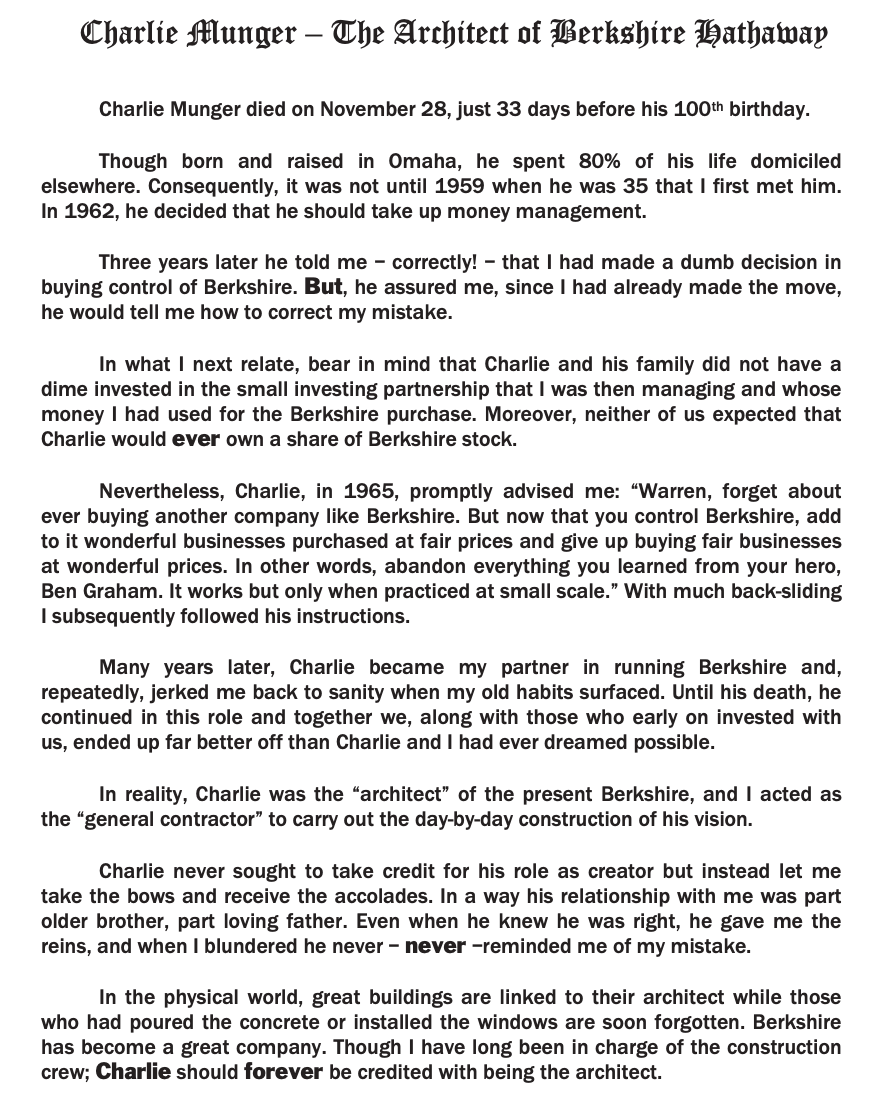

One of the pivotal chapters in Warren Buffett's storied career is his partnership with Charlie Munger, which began in the late 1950s. Munger, a fellow investor and attorney, became vice chairman of Berkshire Hathaway and Buffett's closest investment confidant. Their partnership is often hailed as one of the most successful in the history of American business. Munger's influence on Buffett was profound, particularly in transitioning Buffett's investment strategy from purely undervalued assets to investing in high-quality businesses at reasonable prices. Together, they shared a philosophy that emphasized long-term value, ethical business practices, and the importance of corporate governance. This dynamic duo complemented each other's strengths, with Buffett's analytical prowess and Munger's wit and wisdom, creating an unbeatable combination that has significantly shaped Berkshire Hathaway's success and influenced generations of investors. Their annual shareholder meetings, often dubbed the "Woodstock for Capitalists," became legendary for the insights and entertainment they provided, showcasing not just their investment acumen but their unique blend of humor, philosophy, and practical advice. This was a beautiful letter written by Warren about Charlie when he passed.

Personal Interests

Beyond the financial world, Buffett has a keen interest in playing the ukulele and is a lifelong fan of bridge, often playing with Bill Gates. He also dedicates a significant amount of time to educating others about investing and financial management, frequently offering advice through annual letters to Berkshire shareholders and media appearances.

Charities

Buffett’s philanthropic efforts are monumental. In 2006, he made headlines by committing to give away 99% of his fortune to philanthropic causes, primarily through the Bill & Melinda Gates Foundation. This commitment has led to billions of dollars in charitable contributions, focusing on health, education, and poverty alleviation.

Financial Overview

As of my last update, Warren Buffett's net worth was estimated at over $125 billion, primarily derived from his ownership in Berkshire Hathaway. Despite his wealth, Buffett is known for his frugal lifestyle and for setting a precedent in philanthropic giving.

Quotes

- "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

- "If you don't find a way to make money while you sleep, you will work until you die."

- "Price is what you pay. Value is what you get."

Conclusion

Warren Buffett's journey from a precocious child investor to the Oracle of Omaha offers invaluable lessons in perseverance, investment wisdom, and philanthropy. His legacy is not just in the wealth he has created but in the value he has added to society through his business acumen and charitable efforts. Buffett exemplifies how a principled approach to investing and life can lead to unparalleled success and impact.