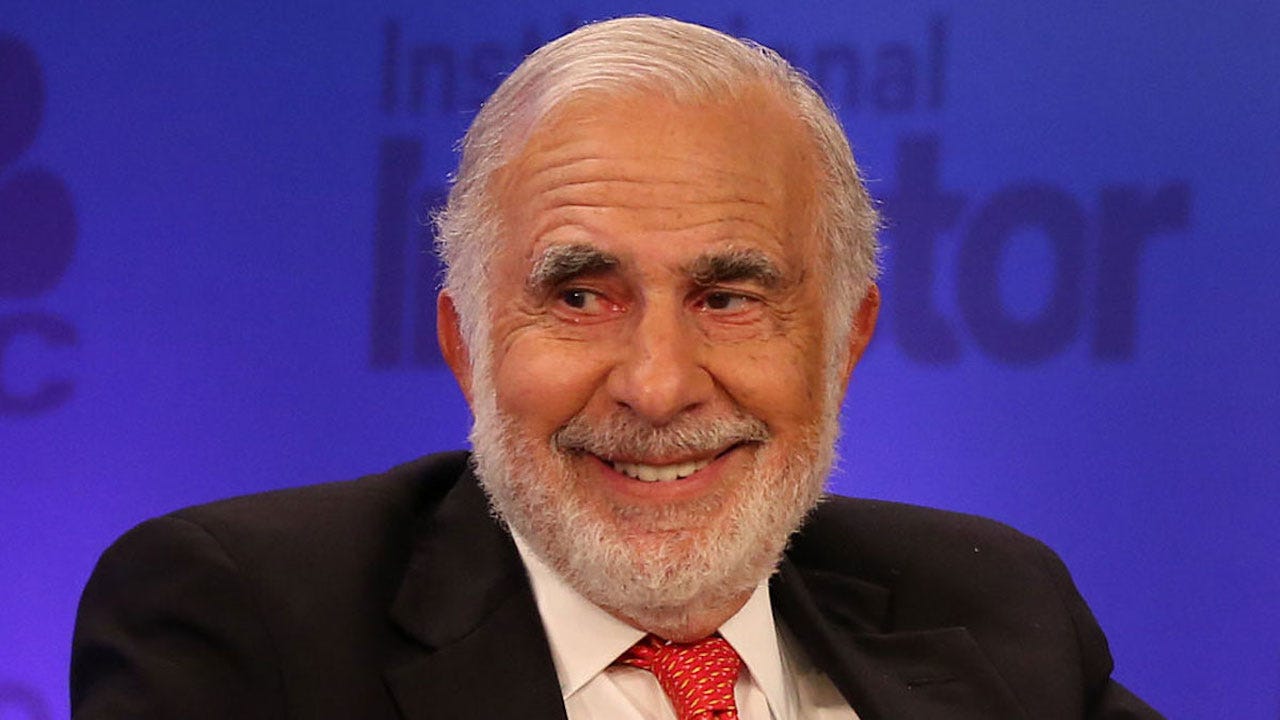

Carl Icahn: The Corporate Raider Who Rewrote Wall Street’s Playbook

Disrupt, Invest, Repeat: How Carl Icahn Mastered the Art of Activist Investing

TL;DR

🏦 Carl Icahn is facing SEC scrutiny for allegedly concealing stock pledges, which adds complexity to his storied career.

📈 Icahn revolutionized Wall Street with aggressive activist investing, reshaping corporate America through hostile takeovers and strategic influence.

💼 Learn about the companies he transformed, the values he championed, and the significant impact of his investments across multiple industries.

🌟 Discover the personal side of Icahn, from his philanthropic efforts in education and healthcare to his passion for fitness and thoroughbred racing.

💬 Get inspired by Icahn’s powerful quotes that reveal his approach to risk, success, and the relentless pursuit of shareholder value.

We have to start with the current legal situation trending about Carl where he had to pay 2M dollars to the SEC for violating the rules. It is absurd to slap a billionaire with a $26B net worth and a $2M fine… White-collar crimes at their finest.

Carl Icahn, the billionaire activist investor, is currently embroiled in a legal controversy with the U.S. Securities and Exchange Commission (SEC). The SEC has accused Icahn of concealing stock pledges that he used as collateral for personal loans, a move that potentially violates securities laws regarding transparency and disclosure. This situation has sparked significant scrutiny, as it highlights the risks and ethical concerns surrounding the practices of high-profile investors like Icahn.

The allegations revolve around the failure to disclose these pledges in a timely manner, which the SEC argues misled investors and the public about the financial stability and obligations tied to Icahn Enterprises. This lack of transparency is particularly concerning given the influence Icahn wields in the markets, and the stakes are high for both his reputation and financial empire.

In response to these charges, Carl Icahn has been fined $2 million. While this sum is relatively small compared to his vast fortune, the fine represents a significant legal and ethical blemish on his career. The situation raises questions about Icahn's adherence to regulatory requirements and the broader implications for the financial practices of billionaire investors.

As Icahn navigates this legal challenge, the outcome could have lasting effects on his legacy. The fine and the allegations of concealed stock pledges are a stark reminder of the complex and sometimes controversial nature of high-stakes investing, where the lines between aggressive strategy and legal obligation can blur. This development adds a new chapter to Icahn’s storied career, one that underscores the importance of transparency and regulation in maintaining trust within the financial markets.

Biography

Carl Celian Icahn was born into a modest Jewish family on February 16, 1936, in Queens, New York City. His father was a cantor and later a substitute teacher, while his mother was a schoolteacher. Despite these humble beginnings, Icahn’s intellectual aptitude was evident early on. He attended Far Rockaway High School and later Princeton University, where he majored in philosophy and graduated in 1957. His interest in philosophy, particularly existentialism, would later influence his approach to business and life.

After Princeton, Icahn briefly attended the New York University School of Medicine but dropped out to join the military reserve. Post-service, he decided to enter the world of finance, securing a position as a stockbroker in 1961. It wasn’t long before he began to climb the ranks on Wall Street, leveraging his sharp analytical skills and fearless approach to trading. By 1968, Icahn founded his firm, Icahn & Co., marking the beginning of a legendary career in finance.

Icahn is best known for his role as a corporate raider during the 1980s, a term used to describe investors who target undervalued companies, purchase significant shares and push for changes to increase the stock’s value. His most famous raid was on TWA (Trans World Airlines) in 1985, where he gained control of the airline and orchestrated a series of moves that would become the blueprint for future activist investors. Despite criticism for his ruthless tactics, Icahn has consistently defended his actions, arguing that they are necessary to unlock shareholder value.

Significant Accomplishments

Carl Icahn's influence on corporate America cannot be overstated. As one of history's most successful and feared activist investors, Icahn has reshaped numerous companies and industries. His significant accomplishments include:

Pioneering Activist Investing: Icahn is widely regarded as the pioneer of activist investing, a strategy that involves purchasing large stakes in companies and pushing for changes to improve shareholder value. His success in this area has inspired a generation of investors to adopt similar strategies.

TWA Takeover: In 1985, Icahn’s hostile takeover of Trans World Airlines became one of history's most famous corporate raids. Although controversial, the takeover exemplified his ability to identify undervalued assets and turn them into profitable ventures.

Influence on Corporate Governance: Icahn has used his influence to push for significant changes in corporate governance, advocating for shareholder rights and more transparent business practices. His actions have led to the removal of CEOs, the breakup of companies, and the return of billions of dollars to shareholders.

Icahn Enterprises: As the chairman of Icahn Enterprises, a diversified holding company, Icahn has built a multi-billion-dollar empire. The company invests in various industries, including energy, automotive, food packaging, and real estate.

Businesses

Carl Icahn’s business ventures are centered around his holding company, Icahn Enterprises (IEP), which he founded in 1987. The company’s mission is to invest in and manage a diversified portfolio of businesses with the potential for significant returns. Icahn Enterprises operates under the philosophy of active engagement, meaning that it does not shy away from making bold moves to improve the performance of its investments.

Values and Mission Statement:

Values: Integrity, accountability, and a commitment to shareholder value.

Mission Statement: To identify undervalued assets, acquire significant stakes, and implement strategic changes to maximize shareholder returns.

Investments and Impact: Icahn Enterprises has a market capitalization of approximately $15 billion (as of 2023) and holds significant investments in various industries. Some of the most impactful investments include:

CVR Energy: A diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries. Icahn’s involvement led to a restructuring that improved profitability.

Herbalife: Icahn famously took a significant stake in Herbalife, defending the company against accusations of being a pyramid scheme and ultimately securing a favorable outcome for shareholders.

Apple Inc.: Icahn's investment in Apple in the early 2010s was instrumental in pushing the company to increase its share buyback program, returning billions to investors.

Personal Interests

Carl Icahn has several personal interests outside the boardroom that provide a fuller picture of the man behind the business mogul.

Philanthropy: Icahn is a noted philanthropist. His foundation, the Icahn Foundation, supports various causes, particularly in education and medical research. He has donated hundreds of millions to causes such as Mount Sinai Medical Center, where the medical school was renamed the Icahn School of Medicine in his honor.

Health and Fitness: Despite his intense work ethic, Icahn strongly emphasizes health and fitness. He is known to exercise regularly and maintain a disciplined lifestyle.

Thoroughbred Racing: Icahn is passionate about thoroughbred racing and has owned several successful racehorses.

Charities

Carl Icahn’s philanthropic efforts are extensive, with contributions that have significantly impacted various sectors.

Icahn Foundation: Established to support education, healthcare, and community development initiatives. The foundation has provided millions in grants and donations to various causes.

Icahn School of Medicine at Mount Sinai: One of his most significant contributions was a $200 million donation to Mount Sinai Medical Center in New York, leading to the medical school being renamed in his honor.

Education Initiatives: Icahn has funded the creation of several charter schools in New York City, known as the Icahn Charter Schools, which aim to provide high-quality education to underprivileged children.

Financial Overview

As of 2023, Carl Icahn's net worth is estimated to be approximately $24 billion, positioning him as one of the wealthiest individuals globally. His immense fortune is primarily attributed to his prowess in strategic investing, with Icahn Enterprises serving as the bedrock of his financial empire. This diversified holding company has been the primary vehicle through which Icahn has amassed and sustained his wealth over the decades.

Income Sources:

Investment Gains: A substantial portion of Icahn's wealth stems from the appreciation of his investments, particularly those managed through Icahn Enterprises. His investment strategy typically involves purchasing large stakes in undervalued companies and then actively engaging in their management to unlock shareholder value. This approach has led to significant gains in companies across various sectors, from energy to technology.

Dividends: As the largest shareholder of Icahn Enterprises, Icahn benefits immensely from the company's dividends. These dividends are a consistent source of income, reflecting the profitability of the diverse portfolio of businesses under the Icahn Enterprises umbrella.

Real Estate: Besides his company investments, Icahn has a robust real estate portfolio. He owns several high-value properties, particularly in prime locations such as New York and Florida. These properties contribute to his net worth and serve as valuable assets in his overall investment strategy.

Economic Milestones:

1980s Corporate Raids: The foundation of Icahn's wealth was built during the 1980s, a period often associated with his aggressive corporate takeovers, or "raids." Icahn’s approach involved identifying undervalued companies, acquiring significant stakes, and then pushing for changes that would increase the companies’ market value. These early successes established his reputation as a formidable activist investor and provided the financial foundation for his future endeavors.

Icahn's ability to continuously adapt and evolve his investment strategies has kept him at the forefront of the financial world. Though often controversial, his methods have proven highly effective in generating substantial returns, making him a central figure in the narrative of modern-day Wall Street. Despite facing challenges and criticisms, including recent legal issues, Icahn's financial acumen and strategic vision continue to sustain and grow his wealth.

Quotes

Carl Icahn is known for his blunt and insightful commentary on the markets, business, and life. Here are five quotes that encapsulate his philosophy:

“The day I woke up and realized that the market doesn’t know what it’s doing is the day I started making money.” 💡

“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.” 📉

“In life and business, there are two cardinal sins: the first is to act without thought, and the second is not to act at all.” 🛑

“You learn in this business: It’s not a sin to make a mistake; it’s only a sin to make a mistake and not learn from it.” 🔄

“My investment philosophy, generally, with exceptions, is to buy something when no one wants it.” 🛒

Random Information

Beyond his well-publicized business ventures, there are a few lesser-known facts about Carl Icahn that offer additional insight into his character:

Drafted for Vietnam: Before becoming a Wall Street legend, Icahn was drafted during the Vietnam War. However, due to his service in the military reserve, he was never deployed to combat.

Avid Chess Player: Icahn’s strategic thinking extends beyond the boardroom. He is a skilled chess player, a game that mirrors the calculated moves and strategic thinking that have defined his career.

Art Collector: Icahn has a passion for art and is known to collect pieces that resonate with his taste. While less publicized than his business dealings, his art collection is another facet of his diverse interests.

Conclusion

Carl Icahn’s journey from a modest upbringing in Queens to becoming one of the most influential figures on Wall Street is a story of intelligence, strategy, and relentless drive. Through his activist investing, he has not only amassed significant wealth but also fundamentally changed the landscape of corporate America.

Despite recent legal challenges and the controversies surrounding his career, Icahn’s impact on the financial world is undeniable. He has inspired a generation of investors to take a more active role in the companies they invest in, advocating for change and accountability at the highest levels of corporate governance.

Icahn’s legacy is one of bold moves and unwavering confidence in his convictions. Whether revered or criticized, his influence on business and finance will be felt for generations. As he continues to navigate the complexities of the market and the legal system, Carl Icahn remains a formidable force, constantly reshaping the world around him.